9 Best Loan Apps in Canada with low-interest Rates in 2024

As the global economy battles heightened inflation, high interest rates on mortgages, increased household spending, Canada was not spared from these harsh realities.

It is difficult to tell what will happen before the year ends especially for Canadians and immigrants trying to stay afloat amid high living costs.

Many run away from debt, not even giving it a second thought and that is understandable.

Considering job security, high interest rates and uncertainity about the future, most canadian immigrants are skeptical about taking a loan.

However, we have researched some of the best loan apps with low interest rates with which you can make headway in this present time.

If you think this may be something that would work for you at this time, let’s explore these loan apps options.

On This Page

Key Takeaways

🎯 If you are not a Canadian or permanently residing in Canada , you cannot access loans from these loan platforms.

, you cannot access loans from these loan platforms.

🎯 These loan apps provide competitive interest rates and offer flexible repayment options, making them a preferred choice for people who want to borrow a loan in Canada.

🎯 Some of the criteria to apply for a loan include being a permanent resident of Canada, having an active banking account (with direct deposit), providing proof of your monthly income, and providing a security deposit (for secured credit cards).

🎯 With the LoanAway app, you can apply for loans ranging from $1,000 to $5,000 to cover unexpected expenses or consolidate debts.

🎯 With LendingMate , you can loan up to $10,000.

, you can loan up to $10,000.

SEE ALSO: 10 Best Credit Cards in Canada With Low Charge Rates

SEE ALSO: How To Make Money On Debt: 6 Smart Ways

SEE ALSO: How To Pay Off Debt on a Low Salary

9 Best Loan Apps in Canada with low-interest Rates

1 Borrowell

Top on the list of best loan apps in Canada in 2024 with low interest rates is Borrowell, a popular loan app that provides personal loans with no hidden fees.

Borrowell’s user-friendly app allows you to check your credit score for free, and if eligible, you can access loans of up to $35,000, making it an excellent choice for various financial needs.

The app is available on both Android and iOS. Borrowell works with over 50+ financial partners in Canada to find loans that match your profile.

2. Mogo

With over 1.8 million Canadians onboard, Mogo is another loan app in Canada offering loans with low-interest rates and flexible terms.

The Mogo loan app comes with financial tools, such as credit score monitoring and budgeting features, which help you understand your financial status while accessing funds at subsidized and affordable rates.

If you pay the loans on time, you get to level up, which gives you access to higher amounts. The loan comes with a 100-day test drive , which means if you don’t enjoy your loan experience in the first 100 days, you can pay back your principal, and they will refund any fees or interest you’ve already paid.

, which means if you don’t enjoy your loan experience in the first 100 days, you can pay back your principal, and they will refund any fees or interest you’ve already paid.

With no minimum balance requirement and for a loan of up to $10,000 with a monthly pay of $438.49 for two years, your total interest would be $523.61.

3. Fairstone

Fairstone’s loan app is also one of the best loan apps in Canada in 2024 that offers loans with fixed interest rates and flexible repayment options.

With loans up to $35,000, it caters to numerous financial needs and credit profiles.

Fairstone offers loans in Canada to people with a fair to good credit score range for debt consolidation, unexpected expenses, and more.

You can check their loan payment calculator here

4. Loan Away

Loan Away is another loan app in Canada designed to facilitate quick and easy loan applications at a low interest rate in 2024. You can apply for loans ranging from $1,000 to $5,000 to cover unexpected expenses or consolidate debts.

One benefit you enjoy with Loan Away is that it does not ask for collaterals (loans are unsecured) o not have to provide them with any valuable items at all.

All you need is a source of income, a Canadian residency, and a valid ID. With an approval rate of 87%, you can still access loans with Loan Away with a bad credit score.

Residents of Ontario, British Columbia, Newfoundland, and Alberta can apply.

SEE ALSO: Make $500 A Week With These Side Hustles In Canada

SEE ALSO: How to Get a Remote Job in Canada while Overseas

5. EasyFinancial

With over 721,000 customers provided with loans, the EasyFinancial loan app is a loan platform that provides you with loans at low-interest rates and flexible repayment terms.

The app’s interface is interactive, making it easier to apply for loans and get funded on time.

Starting with an interest rate of 29.99%, you can loan up to $20,000 and repay between 9 – 84 months.

An option to use your home equity to access a home equity loan from $15,000 – $100,000 for 72 – 120 months is also available, with interest rates starting from 9.99%.

You can loan together with a partner you get a 2% lower interest rate with the co-applicant.

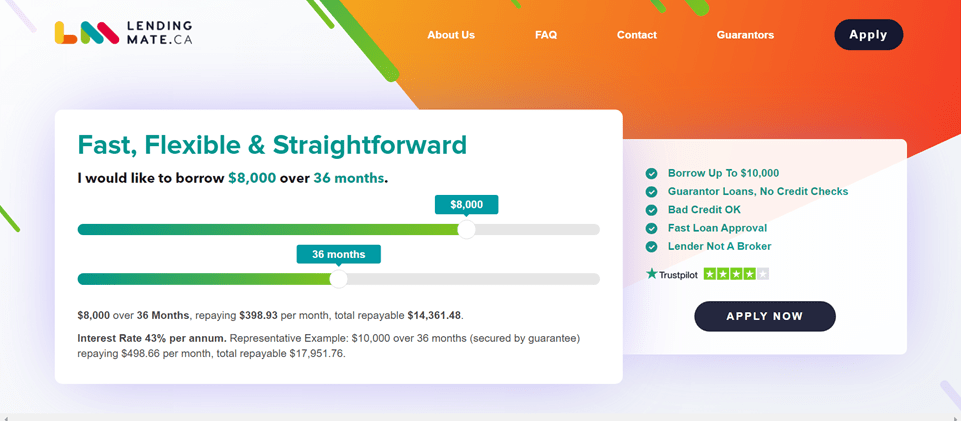

6. LendingMate

LendingMate is another loan app in Canada that specializes in guarantor loans.

The loan app allows borrowers with lower credit scores to secure loans with considerable interest rates once borrowers can tender their guarantors.

The app makes the loan application process faster and you can loan up to $10,000.

You can apply even with bad credit as long as you have a trusted friend or family member with good credit to cosign.

7. PayBright

PayBright is another loan app that specializes in installment loans. As a user, the app allows you to make large purchases and repay them over time at considerable interest rate.

PayBright app is user-friendly, especially for shoppers who enjoy purchasing retail products and services online and in-store.

8. goPeer

goPeer is a peer-to-peer lending platform based in Toronto, Canada connecting borrowers with individual lenders.

The app offers competitive interest rates for borrowers to access loans for urgent expenses while providing investors with attractive returns on their investments.

It is a go-to platform, especially for people who invest to earn profit from the interest paid on the principal amount from the borrowers and the borrowers who need loans to cover their expenses.

goPeer will respond to your loan application within 24 hours. Immediately after your application is approved, the fund is disbursed into your bank account by direct deposit within two business days. The criteria for getting a loan from goPeer include;

- You must be at least 18 years of age

- Have a regular source of income

(minimum annual income of $40,000)

(minimum annual income of $40,000)

- Have a solid credit history (at least 36 months long)

- Have a minimum of 3 trades on your credit report (e.g.: credit card, mortgage, and car loan)

9. Refresh Financial

Last but not least is the Refresh Financial loan app which offers credit-building loans at a low interest rate.

Refresh Financial loans are structured to help their borrowers build or improve their scores and provide them with funds to cover their urgent expenses.

Final Thoughts

The loan apps discussed above are some of the best in Canada, perked with affordable interest rates.

Always ensure you conduct your research before choosing a loan app. That is, compare the interest rates, loan terms, and repayment options to find the one that fits your needs.