5 Financial Truths Most Schools Fail to Teach

After graduating from high school and college, we all discover many realities about going through life that schools failed to teach.

Today, one of these realities is finance.

Taking a critical look, one would confirm that earning money and the ability to manage it is one of the most important areas of concern.

Research shows that only one-third of the global adult population understands the basics of finance.

shows that only one-third of the global adult population understands the basics of finance.

Without a doubt, the deficiency of financial literacy in the world today could be attributed to a lack of native financial wisdom, this native financial wisdom rarely gets taught in schools.

If you think you missed out on some of these teachings on financial management,

I will outline five essential financial wisdom schools failed to teach you.

On This Page

Key Highlights

🎯 Finance management is one of the most important aspects of living today.

🎯 Only a third of the global adult population understands the basics of finance.

🎯 When using credit terms, some people find themselves engulfed in confusion.

🎯 Over 48% of taxpayers do not understand tax brackets.

🎯 Schools failed to teach students the basics of Investment.

🎯 You can improve your financial wisdom by taking up some online courses.

SEE ALSO: 5 Ways to Pay Yourself First When Income Arrives

SEE ALSO: 7 Smart Budgeting Techniques To Keep You Afloat

SEE ALSO: 8 Key Areas Of Finance You Need To Understand

Let’s get to the details…

1. Credit Management

Credit is the trust which enables you to earn loans from people or financial institutions. Although very common, most people do not understand credit management concepts.

is the trust which enables you to earn loans from people or financial institutions. Although very common, most people do not understand credit management concepts.

Some people are confused when others discuss credit terms, from credit reports to credit scores.

Typically, your credit score is the most important thing as far as credit management is concerned.

Thus, it is worth understanding how to maintain it and what reduces it.

The higher your credit score, the better your chances of eligibility for loans and other financial services.

Generally, your credit report contains all your financial records and activities, especially about loans and how you handle them.

In addition, it also contains a summary of your credit score based on your activities.

Typically, most people are ignorant of credit scores.

However, this could make or break your financial image.

Here is a typical outline of credit scores and how they are ranked: Very Poor (300-579), Fair (580-669), Good (670-739), Very Good (740-799), Exceptional (800-850).

2. Tax Systems

Even though every adult pays taxes, most people do not understand it.

Most adults only understand the concepts of taxes when they experience tax payment issues in adulthood.

Despite being one of the most feared areas of finance, it is one of the essential basic financial knowledge to understand.

However, this is one big-time financial wisdom school failed to teach.

According to research , over 48% of taxpayers do not know the tax bracket they fall into.

, over 48% of taxpayers do not know the tax bracket they fall into.

It is even worse that over 90% of Americans are not conversant with the new tax bracket reform.

Without proper tax orientation, you would always suspect deducted figures.

As something that everyone must do at a point, tax management is essential, so schools ought to enable students to understand this early enough.

As part of the school, students ought to understand the concepts of income taxes both at the federal and state level, Medicare taxes, and more.

Also, understanding tax percentages will enable you to know how much will go into taxes from your income.

You could consider taking some online courses to improve your tax management skills.

Here are some free online courses to learn tax management:

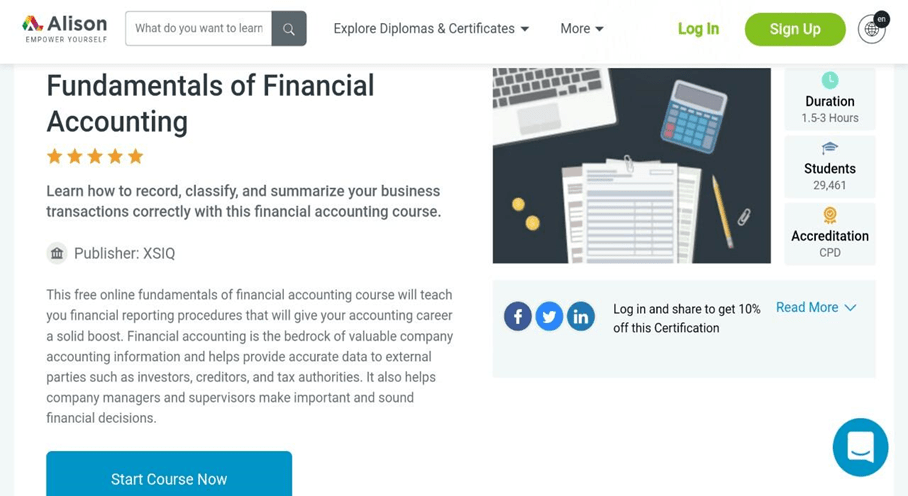

- Fundamentals of Financial Accounting (Alison

)

)

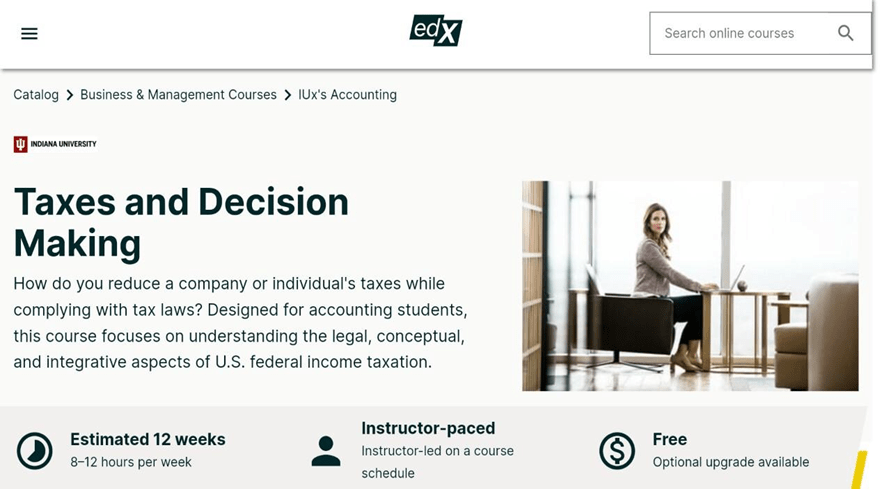

- Taxes and Decision Making (Indiana University via IDX

)

)

3. Budget Management

Understanding Budgets is yet another financial wisdom that makes it to our list.

Without any doubt, Budget management is one of the core basics of finance everyone needs to know about.

According to Investopedia , Budgeting deals with tracking income and expenses to decide on the wisest ways to use your money.

, Budgeting deals with tracking income and expenses to decide on the wisest ways to use your money.

This area of financial management deals with proper financial planning, and it is one of the things schools fail to teach.

One of the most common budgeting rules today is the 50/30/20 rule which depicts going for your needs (50%), then your wants (30%), and then your debts/bills (20%).

This budgeting method is widespread, and it has helped so many people to achieve more financial goals.

Exposing students to budget operations will enable them to develop money management skills at a young age, which would help significantly in the long run.

Unfortunately, this is only an imagination, as schools do not teach budget management.

4. Goal Setting

Without goals, there would be way fewer successful people today.

According to a research survey, 14% of people who have goals are ten times more successful than those who do not have plans.

survey, 14% of people who have goals are ten times more successful than those who do not have plans.

Furthermore, this research reveals that 3% of this 14% of people who write their goals down achieve three times more than those with unwritten goals.

42% of people are more likely to achieve their goals by writing them down.

Although goal setting is above just finance, it plays a role in every aspect of a person’s life.

Thus, it is one of the significant foundations of goodness.

To start utilizing goal setting, you can consider writing all your significant goals down in your diary. After doing this, you can give yourself flexible time frames to achieve these goals.

Today, there are so many goal-setting apps you can try to start making to-do lists and more.

Best Goal Management Apps

5. Investment

Investment is the one singular thing behind all the success of the business world today.

Unfortunately, schools failed to teach students the basics of Investment.

As defined by Wikipedia , Investment is the careful dedication of assets to obtain increased value over a specific period.

, Investment is the careful dedication of assets to obtain increased value over a specific period.

These assets could be in time, effort, or even money.

That might not seem like daunting financial wisdom.

However, when faced with their concepts of compounding interest calculations, stock markets, and risk evaluation, one might end up lost.

There are numerous investment methods today, from short-term certificates of deposit to high-yield savings accounts and even value stock funds.

One of the most popular investments today is Real Estate.

To statistics , the total housing market in the US will hit over $30 Trillion in 2022.

, the total housing market in the US will hit over $30 Trillion in 2022.

Despite being so vast and lucrative, most people still do not fully understand the significant concepts of real estate marketing.

This lack of knowledge primarily results from schools failing to teach investments. You can change that by taking up some online courses.

Here are some free Investment Courses Online:

- Investing Classroom (Morningstar.com

)

)

- Investing and Trading Library (TD Ameritrade

)

)

Final Thoughts

From this article, you can confirm that there is indeed a lot of financial wisdom that schools failed to teach.

When faced with reality, we need most of this financial wisdom in our everyday activities.

Thus, they are so important that everyone needs to understand them at least.

Suppose you intend to boost your knowledge in any financial fields mentioned in this article. In that case, you could consider the free courses given in some of them.

In all, we do wish you success as you strive to improve your overall financial wisdom.