7 Smart Budgeting Techniques To Keep You Afloat

A recent survey revealed that 82% of business failures were attributed to cash flow issues.

revealed that 82% of business failures were attributed to cash flow issues.

Without a doubt, we all tend to run into moments of unforeseen expenses or inevitable setbacks.

While this may seem like a nightmare to many, smart budgeting can make a significant difference when these challenges strike.

Money management is something that takes effort to understand fully.

In this article, I will outline seven smart budgeting tips that will keep you and your business afloat during challenging times.

On This Page

Key Highlights

🎯 82% of business failures happen due to cash flow issues.

🎯 You can start a cash reserve saving by opening a savings or a fixed deposit account for your business.

🎯 Consider taking steps towards creating credit lines for your business.

🎯 Always keep track of your bills, credit card, and loan repayments.

🎯 You have to calculate how much free profit is available before making moves for more inventory.

🎯 Lack of budgeting is one of the primary reasons why businesses fail.

SEE ALSO: 6 Low-Budget Ways To Grow Your Blogging Business

SEE ALSO: 5 Sure Ways to Cut Expenses to Grow Your Business

SEE ALSO: 5 Ways to Pay Yourself First When Income Arrives

Let’s get to the details…

1. Separate Personal Funds From Business Funds

Separating your business funds from your funds is a great money management technique that goes a long way.

From the legal ramifications to tax management issues and other problems, mixing your business and personal funds is risky.

Besides the tax management headaches, accounting issues, and legal ramifications, there are many problems associated with the mixing of business and personal expenses.

It is advisable not to do this, as it leads to business failure in some cases.

Although this is not a healthy business habit, over 50% of global entrepreneurs do it.

Fund separation allows you to understand your financial status better to know when you are overspending or misusing business profits.

When you mix personal funds with business funds, it becomes impossible to properly track all business money transfers.

As of 2022, fund separation is one of the most effective intelligent budgeting tips to keep you afloat.

2. Monitor Your Revenue

Revenue is like the blood of your business, your business depends on it.

To track yourself at all times, you must know your profit range to avoid excessive spending.

If your gross profit keeps going on the rise per month, it is an indication of success.

Else, it is advisable to reduce your spending rate.

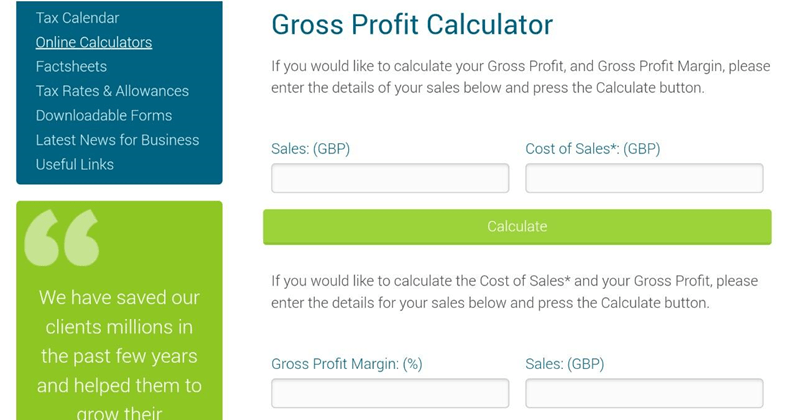

To calculate the gross profit margin of your business, you have to subtract the total costs of your business from the total revenue generated.

Upon making this subtraction, you can get your profit percentage by dividing your answer by your net sales.

With sufficient knowledge about the profit range of your business, it becomes easier to understand your financial strength and what you’re capable of doing without running bankrupt.

To quickly check your gross profit, you can consider using online tools like the gross calculator by Growyourbusiness.co.uk .

.

3. Make Only Plan Purchases

In some instances, it is straightforward to get overwhelmed with unnecessary purchases.

However, this is against the principles of money management.

To ensure an intelligent budgeting habit, you must time all your purchases to make sure you pay only the most essential bills.

Moreover, it is also advisable to only make massive purchases with enough reserve at hand, just in case an unforeseen emergency pops up

4. Be Careful With All Credit Deadlines

The Federal Reserve System (USA) revealed that 70% of small businesses have outstanding debts.

(USA) revealed that 70% of small businesses have outstanding debts.

If you are not cautious of all your deadlines and when your bills are due, you might get caught up suddenly.

Being caught off-guard could keep your business in a messed-up state.

Thus, it is advisable to keep track of your bills, credit card bills, and loan repayments.

From interests to lower business credit and other complications, so much can go wrong by overlooking deadlines.

To avoid getting stuck with unforeseen bill payments and deadline encroachment, you could consider keeping records of all your top deadlines.

5. Manage Your Inventory Properly

If you are a small business owner, you could consider controlling how much you buy inventory.

Working on improving your inventory management can assist you in managing money in a business.

To always be on track, you need to know how much inventory you already have and how much you need to create a balance.

Also, you have to calculate how much free profit is available and how well your business sells before making moves for more inventory.

6. Set Up Emergency Funds

The best intelligent budgeting technique to keep you afloat at all times is to set up an emergency funds account.

With emergency funds, it becomes significantly easier to prepare for unforeseen expenses which may arise.

These cash reserves are one of the best money management moves, as they improve cash flow management.

Today, you can start a cash reserve saving by opening a savings account for your business.

To maintain your cash reserve’s smooth operation and growth, you have to make regular deposits when the profits come in.

7. Create Possible Lines of Credit

Another intelligent technique that can always keep you afloat is to work towards creating easy access to cash via credits.

If you are a small business owner, you could consider taking steps towards creating credit lines for your business.

You can create credit lines by contacting your bank loan officers and discussing terms for possible loans in cases of short-term challenges.

Establishing good credit relationships with financial institutions is always a safe and smart move.

Thus, you are supposed to utilize this as an intelligent way to generate funds in downtimes always to keep you afloat.

Today, there are numerous lending platforms like Lendio where small businesses can secure loans.

where small businesses can secure loans.

Overview of 7 Smart Budgeting Tips To Keep You Afloat

1. Set Up Emergency Fund Reserves

2. Create Possible Credit Lines

3. Separate Personal Funds from Business Funds

4. Monitor Your Gross Profit

5. Make Only Calculated Purchases

6. Be Careful With All Credit Deadlines

7. Manage Your Inventory Properly

Frequently Asked Questions (FAQs)

What is the best practice in budgeting?

One of the essential intelligent budgeting practices is employing the 50/30/20 rule.

Via this rule, all you need to do is separate your monthly income (excluding tax) into 50% for your needs, 30% for your wants, and 20% for paying off debts or saving.

This method is one of the easiest budgeting methods, as it helps you manage all aspects of spending in a balanced way.

What is the most common budgeting mistake?

When it comes to budgeting, people tend to make lots of mistakes.

From forgetting about income tax to excluding an emergency fund, people make many errors while budgeting.

However, the biggest budgeting mistake is being without a budget.

While making a budget may feel daunting, it is one of the essential parts of success in a business.

Thus, every business should have a smart budget plan.

Final Thoughts

Smart budgeting can go a long way when it comes to staying afloat.

Now, keeping a budget is not always as easy as it seems.

However, with the seven techniques given in this article, you operate your business and scale through tough times.

While budgeting tips may seem unimportant, they are one of the primary foundations for business success.

As an individual or company, carefully following the steps given in this article would go a long way.

Moreover, these techniques will enable you to make the right decisions and stay afloat during times of challenges.