How To Make Money On Debt: 6 Smart Ways

The idea of being in debt is a terror for many people, and it can be a significant source of stress. But, for others, debt can also be a source of motivation and opportunity to generate income.

By taking a proper approach to debt management, you can quickly pay down your balances and turn your debt into a source of income.

This article will explore six smart ways to make money on debt, including creating a repayment plan, investing in debt, and capitalizing on credit card rewards.

Whether you want to increase your income or make the most of your financial situation, these strategies can help you achieve your goals.

On This Page

Key Highlights

The decision of paying a debt or investing with the money depends on your financial situation at the point of making the decision.

There are various types of debt, including student loans, credit card debt, mortgages, car loans, and personal loans.

Understanding credit card rewards programs is a great way to get the most out of cashback, points, or miles on your purchases.

High-yield bank savings have always been a primary low-risk money management system since the early foundations of financial institutions.

Understanding Debt: A Brief Overview

Debt is money you borrow from a lender, which you must pay back in a specific timeframe, often with additional interest.

Though debt can sometimes be stressful, it is unavoidable for most people, as they take loans for compulsory expenses like tuition fees, financial needs, and property purchases.

While debts can be classified as burdens on the borrower, it also has an advantage, enabling you to achieve quick financial goals.

There are various types of debt, including student loans, credit card debt, mortgages, car loans, and personal loans. Each class has different payment terms, interest rates, and consequences for non-repayment.

It is essential to understand your debt types, how much you owe, and the interest rates you will be paying.

Ways To Make Money On Debt

Below are some of the top investment opportunities which you can utilize for profit-making while in debt:

1. Peer-to-Peer Lending

Peer-to-peer lending is another investment opportunity allowing you to make money on debt. This system involves lending money to individuals or small businesses seeking loans.

You can invest in multiple loans to diversify your portfolio and minimize the risks. But you must research properly and choose a reputable P2P lending platform.

Some of the top peer-to-peer lending platforms for investors are Kiva and Prosper

and Prosper . You can start on any of these platforms and accumulate profits from your interests as a lender, and then use the extra funds to clear off your own debts.

. You can start on any of these platforms and accumulate profits from your interests as a lender, and then use the extra funds to clear off your own debts.

2. Credit Card Rewards

When you are in credit card debt, one of the smart ways to make money on debt is to utilize credit card rewards.

Understanding credit card rewards programs is a great way to get the most out of cashback, loyalty points, or milestone rewards on your purchases.

Every credit card company has a different set of reward programs, so choosing one that aligns with your spending style is essential.

These rewards can also be in the form of signup bonuses, gifts from shopping portals, or referral bonuses. They allow you to earn while carrying out your regular transactions, and you can redeem them for cash, which you can, in turn, use to pay up significant chunks of your debts.

3. Consider Arbitrage Trading

Arbitrage trading is taking advantage of price differences in products across the market. Suppose a product has different price tags across other markets. In that case, you can utilize this difference by purchasing it at a lower price and selling it to a high-price market for profit.

It is one of the quick ways to profit from trading, and you can even use some of your debt as capital for trusted purchases.

You can purchase cheaper items in online stores, utilize free delivery offers, and sell at slightly increased amounts around your area for some profit.

It also applies to credit card purchases, so you can start with credit card arbitrage . It involves making purchases with your credit card and reselling your bought items profitably. It is also a tested method that generates a lot of profit, and it can allow you to pay up existing balances with ease.

. It involves making purchases with your credit card and reselling your bought items profitably. It is also a tested method that generates a lot of profit, and it can allow you to pay up existing balances with ease.

4. Low-Risk Money Management

One way to make money on debt is to involve in low-risk investments such as certificates of deposits (CDs), short-term bonds, treasury bills, and high-yield savings accounts.

These investments offer a fixed income stream and are less risky than stocks. But, of course, they may have lower returns than other investment options.

High-yield bank savings have always been a central low-risk money management system since the early foundations of financial institutions in the 1600s.

have always been a central low-risk money management system since the early foundations of financial institutions in the 1600s.

5. Utilize Side Hustle Ideas

Another smart way to earn while in debt is to utilize side hustles while doing your daily job. Consider some side hustles, as they can significantly increase your overall income.

You are on the right page if finding the right side hustle to increase your earnings is challenging.

At HustleCabal , our experts always search for the best side hustle ideas for professional workers

, our experts always search for the best side hustle ideas for professional workers . Thus, you can always find a suitable hustle and maximize your overall earnings.

. Thus, you can always find a suitable hustle and maximize your overall earnings.

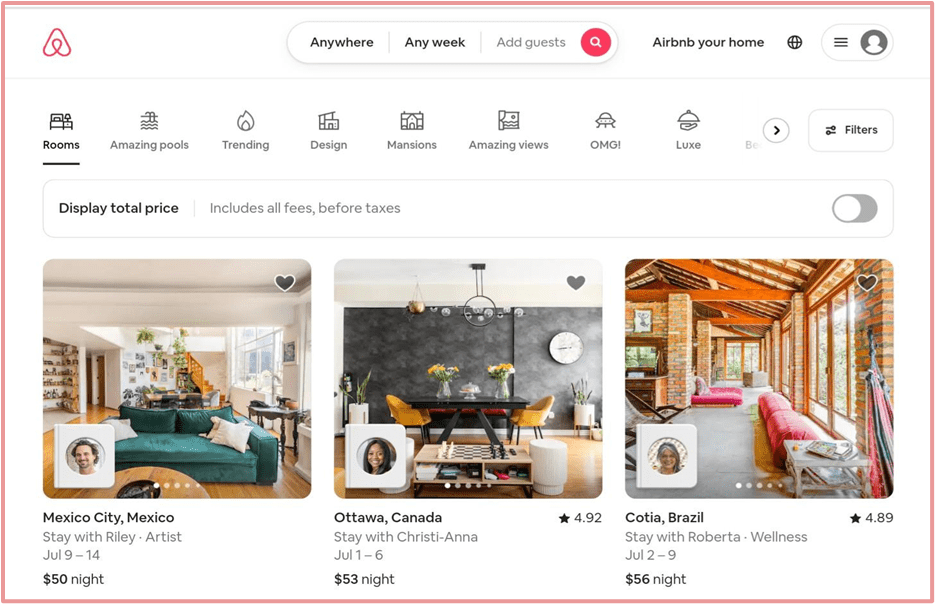

6. Rent Out Property

Another way to make money on debt is to rent out property to generate income. If you have a spare room or an investment property, renting it can be an excellent way to generate money while you are still in debt.

Before renting a property, you must calculate and draft your potential income. You can research rental rates in your area and compare them to your property’s features and location. You should also factor in any expenses, such as repairs or property management fees.

One key factor in renting out your property is marketing. Once you have determined your income potential, you must market it to potential renters. To do this, you must take high-quality photos and write a detailed listing highlighting your property’s best features.

You can advertise your rental property on social media or websites like Airbnb or local newspapers.

or local newspapers.

To protect your investment in the long run, you must screen your potential tenants before collecting rent. Suppose you need more time or expertise to manage your rental property. In that case, you must consider hiring a property management company to handle these tasks.

Final Thoughts

Making money is a challenging task. But, with the right strategies, you can permanently unlock a new phase of financial freedom and achieve better goals.

As you can see from this article, there are many smart ways to make money from a debt. Thus, you can always utilize these little ideas and tips to make a huge difference when in debt.

Remember, while debt can be a challenge, it can also be an opportunity. As a result, it is left for you to take a proactive approach to managing your debt to pave the way for a brighter financial future.

In all, we do wish you good luck!

FAQs

Below are some of the frequently asked questions about making money on debt:

Can I make money on debt?

Yes. You can make money on debt. However, it all depends on the approach you take. With proper tools and orientation, you can create a repayment plan, take advantage of your credit card rewards, invest in debts, and negotiate lower interest rates from your lenders.

Can I negotiate a lower interest rate on my debt?

Yes. You can always negotiate a lower interest rate on your debts. However, the process all depends on your lender and the debt repayment rules of their institution.

Negotiating a debt repayment interest rate can be helpful, so it is worth trying. Find it hard negotiating with your lender.

You can also use credit counseling services, as their agents can help you contact lenders on possible deals.

Should I pay off the debt or invest?

The decision of paying a debt or investing with the money depends on your financial situation at the point of making the decision.

Also, another factor to consider is the loan repayment duration. You can explore investment ideas if you still have enough time to pay off a debt.

However, if your debt repayment time is imminent and features high-interest rates, you are better off clearing your debts before investing.